Only 6% of properties in Central Florida currently have flood insurance, which experts say is a concerningly low number as storms get stronger and dump more rain, sometimes in areas that were previously rarely affected by floods.

Four powerful hurricanes have struck the state in the last five years: Ian, Helene, Idalia, and Milton. These storms have severely damaged Orlando and the surrounding areas, costing over $60 billion in damage from catastrophic flooding.

Government authorities and insurance experts worry that many homeowners may not receive financial assistance if flood waters destroy their homes as the 2025 hurricane season peaks in mid-September.

According to the Federal Emergency Management Agency, little under 20% of Florida’s approximately 11 million properties, primarily along the Atlantic and Gulf coasts, currently have flood insurance of some kind.

According to an Orlando Sentinel review of government data, the percentage of policyholders in Central Florida is far lower, with an average of roughly 6% of properties in Orange, Seminole, Osceola, and Lake counties having flood insurance. In Lake, the coverage rates are roughly 3%, whereas in Osceola, they are little over 6%.

Despite the increased strength of tropical storms over the past 10 years, experts are concerned that the number of flood insurance coverage in the state has not increased.

For instance, Florida had just under 2 million flood insurance coverage in 2017. Even though the state added over 700,000 residences last year, there were still over 2.1 million policies. There were no insurance trend figures available for counties in Central Florida.

According to Mark Friedlander of the Insurance Information Institute, an association for insurers, many individuals, particularly in Central Florida, do not believe they are at significant danger of flooding because they are not near the shore. However, floods are still occurring in unexpected places. Everywhere in Florida is flooded. Every one of the 67 counties is vulnerable to flooding. Furthermore, it need not occur during hurricane season.

In 2022, Hurricane Ian flooded a retirement complex in Kissimmee, an elementary school in east Orange County, homes in Orlando’s College Park district, and businesses in downtown Sanford.

Then, in October of last year, Hurricane Milton swept across the Florida peninsula, soaking the area once more and flooding homes and roadways with over 10 inches of rain in some areas.

According to Friedlander, many locals mistakenly believe that flood damage will be covered by their homeowner’s insurance coverage. But in order to cover damage from ground water, especially intense rain, they require flood insurance.

According to his group, the number of new flood insurance policies issued in Florida has been declining recently. This is due to the fact that many homeowners would forego flood insurance as their finances become stretched by the approximately 30% increase in homeowner insurance costs over the past five years.

According to him, more people will drop it if they are not forced to have it. And that’s a shame.

Sarah Clark witnessed firsthand the advantages of flood insurance as well as the devastation that a hurricane’s torrent can cause. When floodwaters from Ian climbed more than a foot inside her Geneva home on Lake Harney in September 2022, she and her family in east Seminole watched in dread. Hours after Ian left the region, the water persisted.

“Water from Ian came up through the sliding glass doors at a family member’s house in Winter Park, which had never happened before,” Clark said.

Thankfully, she added this week, our flood insurance paid out without any problems. I would advise everyone to purchase it.

The National Flood Insurance Program, also known as NFIP, provides coverage with lower prices than private insurers, and this is how the majority of people in Florida obtain flood insurance. FEMA is in charge of running the program.

The location of a home and whether it is in a high-risk or moderate-to-low-risk flood zone can affect the expenses. The average NFIP premium in Central Florida is roughly $850 annually. The national program covers 38,264 of the 733,689 houses in the four counties.

The price range for a private insurance provider is $1,300 to $2,000. However, according to Friedlander, those plans usually provide more comprehensive coverage and pay for living expenses for a homeowner who is waiting to rebuild after their home was destroyed. NFIP won’t.

During press conferences held throughout the state at the beginning of hurricane season, which begins on June 1 and ends on November 30, state officials urged citizens to get flood insurance policies and prepare for potentially dangerous storms.

According to Senator Rick Scott, “if you really look at these hurricanes, they really have turned into big water events.” People believed that we would never experience flooding, but we have been experiencing severe flooding.

Since her neighborhood just west of downtown Orlando has been prone to flooding, Lervesca Levi Williams, who was forced from her Orlo Vista house by Ian’s floodwaters, has had flood insurance via NFIP for a long time. She witnessed a violent afternoon storm in July engulf Ronnie Circle, her neighborhood in Orlando, with water.

She does not, however, believe that all homeowners ought to purchase it.

It costs a lot. even for me. She stated this week that many pensioners simply cannot afford it if they had never experienced flooding.

Flood insurance is an excellent idea, according to Oviedo Mayor Megan Sladek. She hasn’t bought an insurance, though, because she has lived in her current home—the oldest in Oviedo—for almost 20 years and it has never flooded.

When they built my house, they chose the highest spot in the neighborhood. She added that there was a great deal of wisdom in that. However, that luxury isn’t available to everyone. I would strongly advise acquiring it if you’re close to any type of water.

According to Orlando City Commissioner Patty Sheehan, flooding is occurring in numerous Central Florida places where it has not happened much in the past. For instance, during Ian, homeowners were forced to use kayaks on the roads when Lake Davis and Lake Cherokee in downtown Orlando combined into a single, sizable body of water.

According to her, storms are becoming more severe.

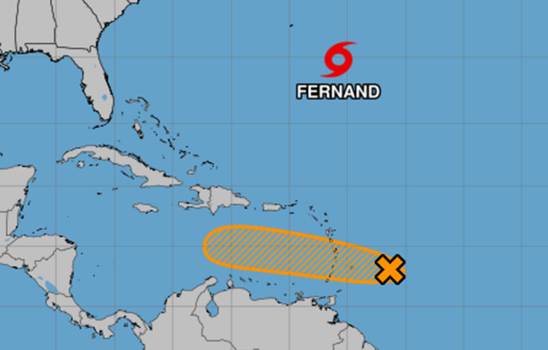

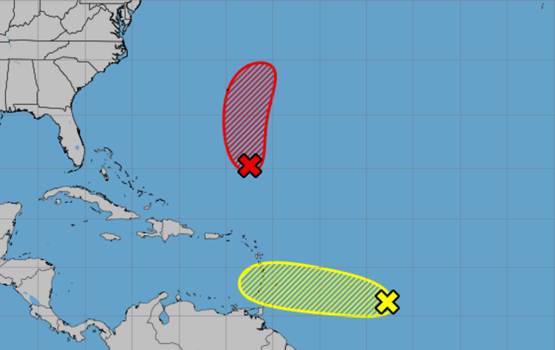

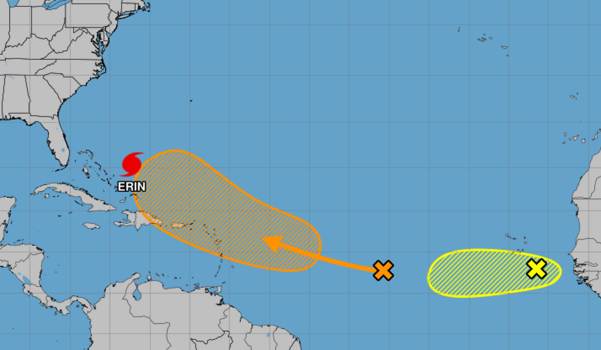

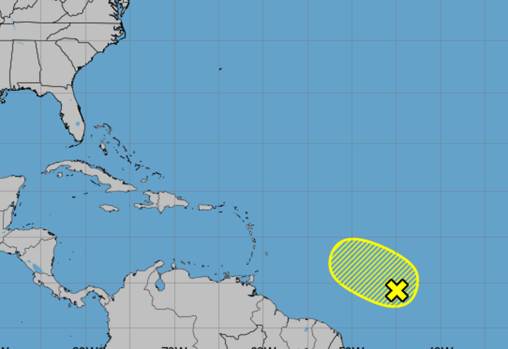

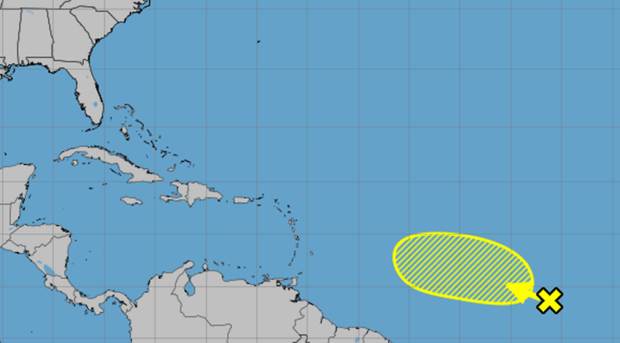

As it sailed over the abnormally warm Atlantic Ocean seas this month, Hurricane Erin became one of the fastest-growing hurricanes in history, exploding in strength from a Category 1 storm with winds of about 75 mph to a Category 5 storm with gusts of 160 mph in little over 24 hours. Erin caused floods and storm surge in North Carolina’s Outer Banks, cutting off access highways, however it did not reach Florida.

Erin’s strengthening comes after Milton, which last October in the Gulf reached 180 mph and became a Category 5 storm.

According to Sheehan, massive storms can overwhelm municipal stormwater drainage systems, causing neighborhoods to be inundated with water and necessitating flood insurance.

Everyone should purchase flood insurance, according to U.S. Representative Randy Fine, a Republican whose district includes parts of Sanford and Leesburg and runs along Florida’s eastern coast between St. Augustine and South Daytona.

In regard to Hurricane Helene, which ravaged areas in North Carolina in September, he noted at a news conference in June that “I think a lot of people in that state learned a hard lesson about that.”

Hurricanes in 2004 and 2016 caused wind and flooding that almost damaged Fine’s and his parent’s homes. “I understand what it’s like to experience this firsthand,” he remarked.