Written by AP Business Writer Anne D. Innocenzio

NEW YORK (AP) Target, which is having trouble competing with rivals like Walmart, is depending on an experienced employee to bring back its charm.

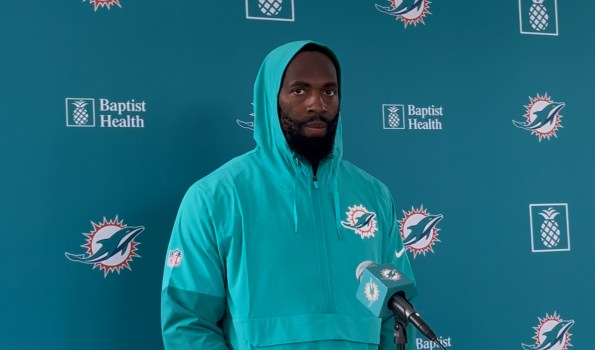

Michael Fiddelke, who has been with Target for 20 years, will take over as CEO on February 1st, the Minneapolis-based retailer announced on Wednesday.

He replaces Brian Cornell, who helped revitalize the business when he took over in 2014 but has had difficulty turning back poor sales in a retail environment that has become more competitive since the COVID outbreak.

Target’s supply chain has been redesigned by Fiddelke, who has also reduced expenses while growing the company’s physical locations and online offerings. The business declared in May that he would head a new office that would assist boost sales by focusing on quicker decision-making.

Target is losing market share to competitors, its stores are disorganized and understocked, and its sales are in a slump as Fiddelke takes over.

Regaining the company’s merchandising authority, enhancing the shopping experience by ensuring that shelves are regularly filled and stores are clean, and investing in technology at the company’s stores and in its supply network are his three top priorities when he assumes the position.

“I think Target has been at its highest in my 20 years when we’re setting the trend for retail, having swagger in our marketing, and leading with swagger in our merchandising authority,” he remarked.

On Wednesday, the announcement of the leadership shift coincided with Target’s release of yet another quarter of weak performance.

Some observers were taken aback by the announcement since they thought Target would choose an outsider to make things better. GlobalData Retail managing director Neil Saunders expressed conflicting emotions.

“This is an internal appointment that does not necessarily remedy the problems of entrenched groupthink and the inward-looking mindset that have plagued Target for years,” he said, adding that he believes Fiddelke is talented and has a somewhat different perspective than current CEO Brian Cornell.

In the quarter that concluded on August 2, Target’s net income decreased by 21 percent. The company reported a 1.9% decline in comparable sales from both existing physical locations and online platforms, indicating a small decline in sales. In eight of the last ten quarters, including the most recent one, Target’s comparable sales have been flat or dropping.

Since joining rival Walmart and several other well-known American corporations in reducing corporate diversity, equality, and inclusion efforts in late January, Target, which operates over 1,980 shops in the United States, has become the target of customer boycotts.

Additionally, Target’s sales have stagnated as consumers seek lower pricing at Walmart and discount department stores like TJ Maxx. However, many analysts believe that Target is struggling because customers no longer view the store as the destination for reasonably priced yet fashionable goods—a market niche that long ago gave the business the ironic moniker Tarzhay.

According to Fiddelke, Target actually only increased or maintained its market share in 14 of the 35 item categories it monitors in the first half of its fiscal year.

As consumer prices rose sharply due to U.S. inflation, Walmart increased its market share among households earning over $100,000. According to market research firm Consumer Edge, Target’s customer growth has been driven by lower-income shoppers, indicating that the retailer may have lost favor with wealthier consumers.

According to Michael Gunther, Head of Insights at Consumer Edge, it’s probably not the best indicator, particularly as consumers with higher incomes continue to do a little better during uncertain economic times.

Members of Target’s executive team informed investors in March that they intended to increase the number of store label brands Target offers and reduce the time it takes for new products to move from concept to store shelves in order to restore the chain’s reputation for offering fashionable goods at affordable rates. According to officials, the actions would help the business keep on top of trends.

“Our guests are looking for Tarzhay in the world we operate in today,” Cornell informed investors. Customers first used that phrase decades ago to describe how we make the ordinary extraordinary and how we unexpectedly enjoyed doing routine shopping.

Cornell, 66, held executive roles at retail and consumer goods companies for almost 30 years before to joining Target in 2014. These roles included CEO at Michaels, Walmart’s Sam’s Club, and PepsiCo America Foods, as well as chief marketing officer at Safeway Inc. The board removed a rule requiring its chief executives to retire at age 65 and prolonged his employment for a another three years in September 2022. Cornell will become the board’s executive chair when Fiddelke assumes the role.

Target was dealing with a different set of issues when he arrived.

Cornell took over for former CEO Gregg Steinhafel, who resigned almost five months after Target revealed a massive data breach in which hackers stole the credit and debit card information of millions of consumers. The chain’s earnings and reputation were severely harmed by the heist.

By having his staff revitalize Target’s store brands, Cornell was able to boost sales. Its portfolio now consists of 40 private label products. Prior to the pandemic, Cornell led the company’s initiative to turn its stores into distribution hubs in order to reduce expenses and expedite deliveries.

Target’s same-day, in-store fulfillment services were strengthened by its 2017 acquisition of Shipthelped. Additionally, Cornell concentrated on better tailoring its stores to the local population.

Target and its competitors saw a surge in sales during the coronavirus pandemic as consumers stayed at home and purchased kitchenware, furniture, and pajamas. And as consumers left their houses and visited stores, sales continued to soar. However, the spending binges gradually stopped.

Target reported a 52% decline in profits during the first quarter of 2022 compared to the same period the previous year, as inflation began to rise. The business had to sell off extra inventory when Americans’ purchases of large TVs and appliances during the pandemic waned.

Target reported a fall in comparable sales for the first time in six years in July 2023 as consumers cut back on their spending due to inflation.

Furthermore, according to Fiddelke, Target began to lose its position as a style authority by emphasizing too many basic home furnishings and not enough fashionable things.

The yearly line of LGBTQ+Pride items that Target shops carried that year was met with negative customer feedback, which further reduced sales.

Target has been the target of more coordinated boycotts by customers, despite Walmart initially pulling back from its diversity programs. Because Target had previously positioned itself as an advocate for inclusivity, organizers have stated that they saw the company’s behavior as a larger betrayal.